CX & Product Strategy for Small Businesses

KeyBank/XUP Payment – Lead UX

The Team Setup – Kickoff

The startup XUP Payments was a startup acquired by KeyBank in 2021. The $187 billion asset bank bought the fintech to streamline its commercial payments business. XUP Payment was KeyBank’s solution to bring payment devices to small businesses—a one-shop set for getting one’s business up and running.

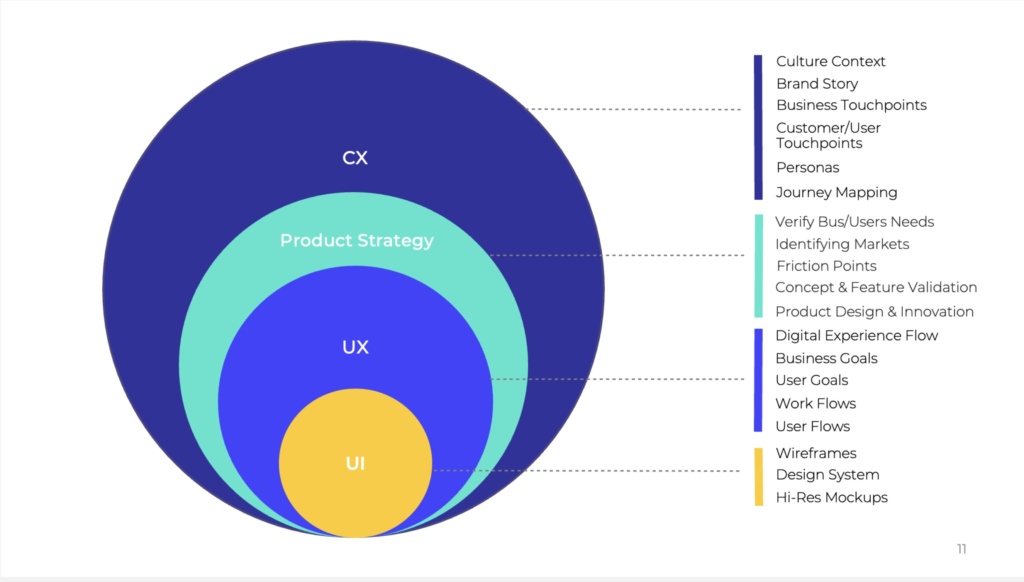

My role was to mentor and guide the UX/UI team in designing platforms to onboard new businesses (In-branch or online).

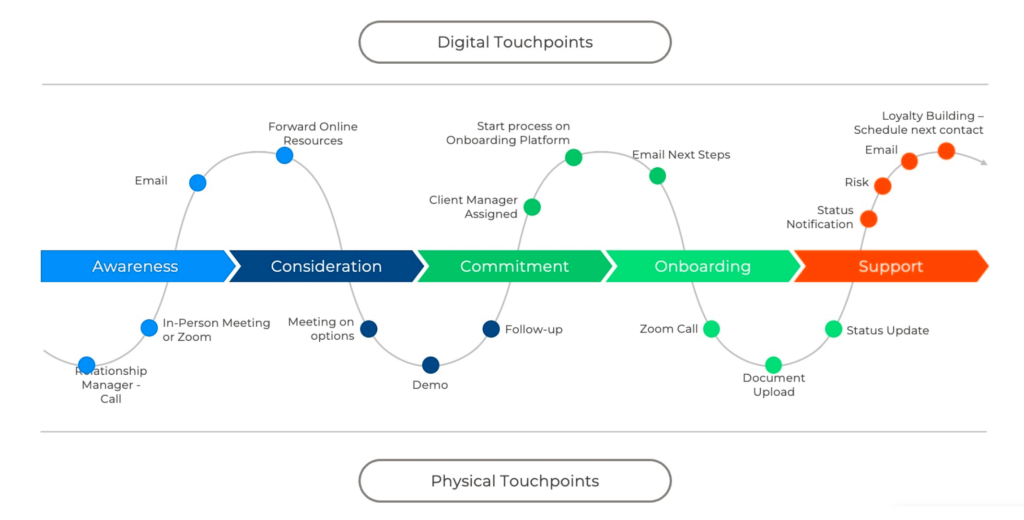

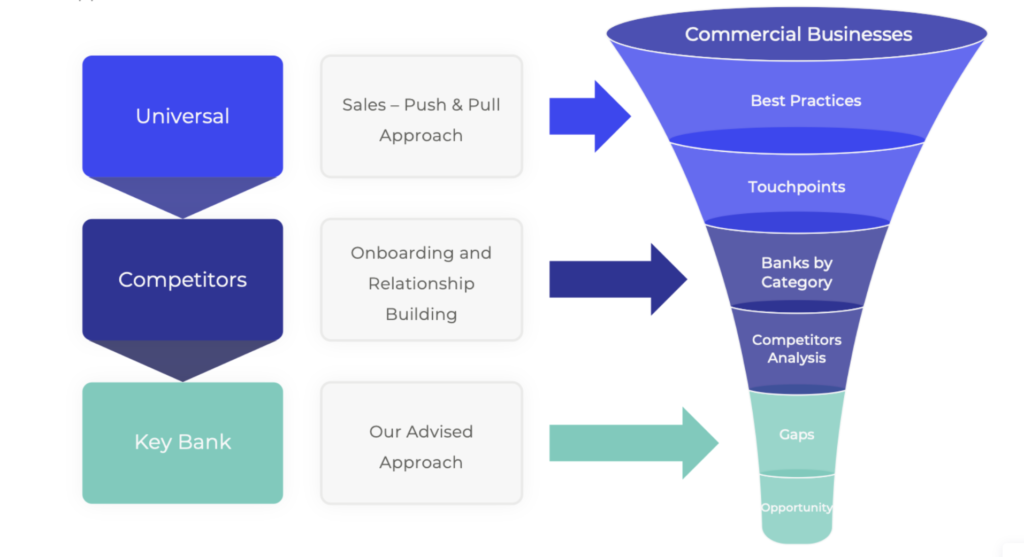

We research the current and competing customer service experience from the first sales meeting to the onboarding process.

As a lead, the overall goal was to work with the stakeholders and guide the design team to implement needed product changes.

CX/UX Research – Case Study

How do we cross-promote DDA bank accounts with our credit card customers obtained through a 3rd Party?

The value I provided was to research who the actual customer was vs. the user and what the overall best journey experience was. We built partnerships with independent software vendors, like Epic Systems, to reference KeyBank financial services like credit card payments.

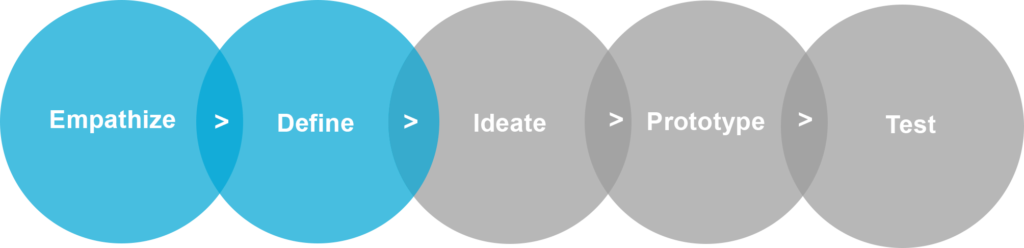

My CX/UX research approach:

- Held interviews with stakeholders, key customers, experts in the ISV space, and merchants

- Competitive analysis of set-up payment companies such as Stripe (traditional and fintech)

- Research the latest trends and issues with merchant payments

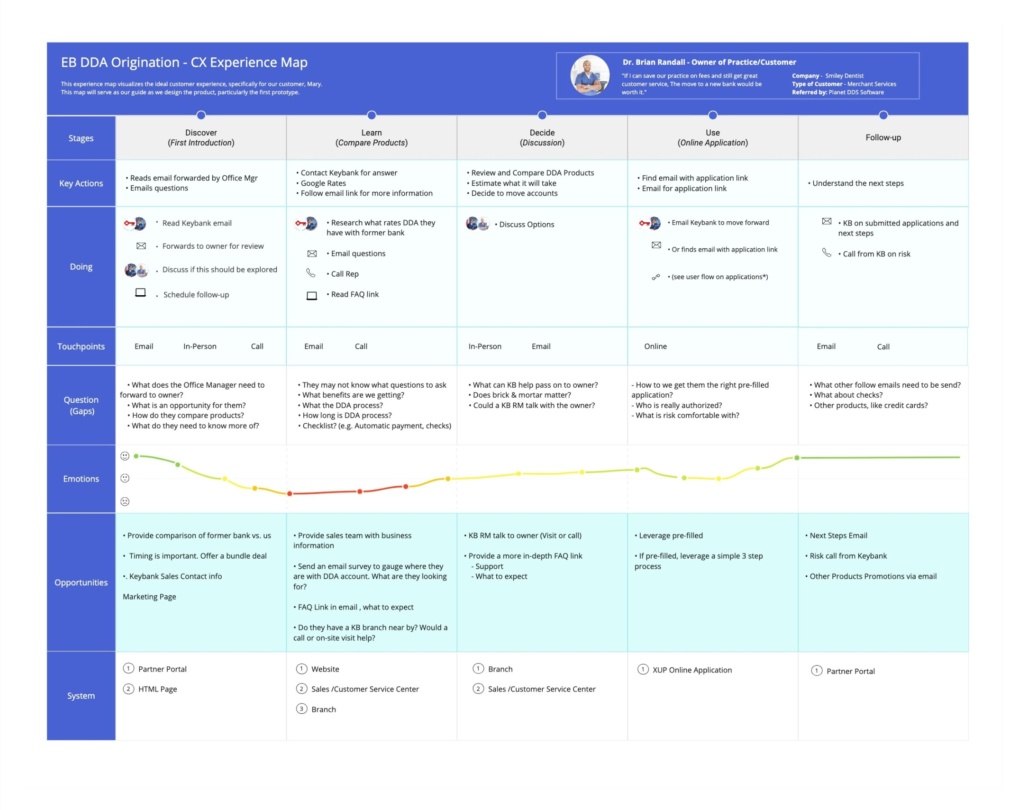

- Creating a current journey map of our ISV companies and our users, direct merchants

Research Breakdown

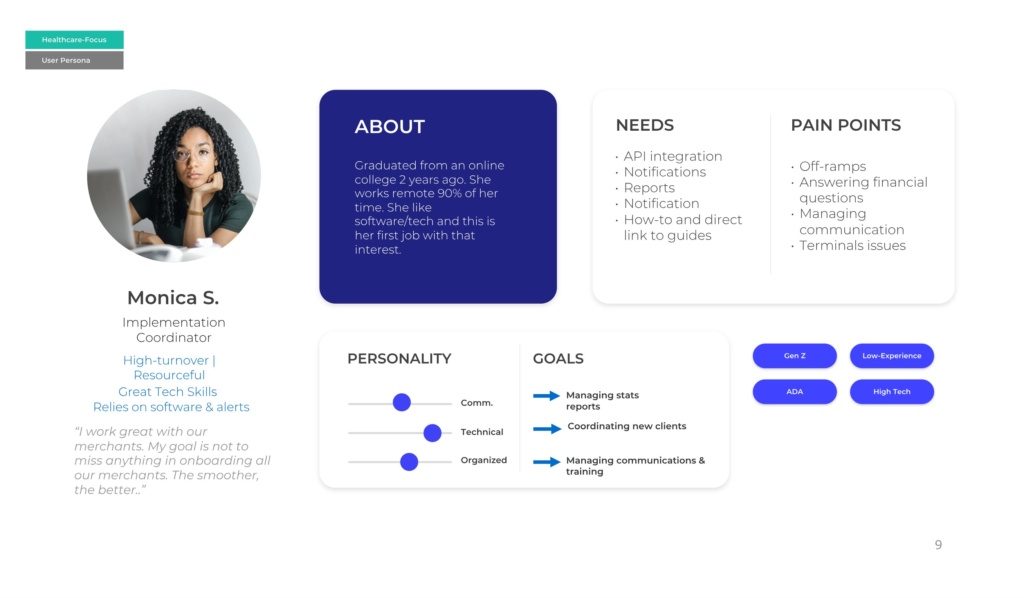

Persona

Found Gap and our Opportunity in the ‘Learning’ Stage –

From the journey map, one of the was a key discovery was office managers’ heavy task to weigh the benefits of moving to another bank and make the arguement to their boss.

What are the headaches? How long will it take? Are the rates and services better than the other bank?

….Are we really getting a deal?

Results

We needed to build trust.

I advised we build phases of communication and not just build one UI design step of a pre-filled form in an email campaign.

We strategized by:

1. Design a marketing campaign with the ISV partner. Trust through their software management provider and outline central reporting and embedded finances.

2. Leverage our partner’s notification with their system to contact KeyBank.

2. Setting up a ‘How Can We Help’ contact. Once they sign up with payment services, An assigned relationship manager would directly email and reach out to talk to the Office Manager of the business.

3. Leverage our partner’s survey notification to ask about their banking services. What would they like to improve? (lower fees, same-day payment, etc.).

4. The relationship manager would be the contact one. We would leverage pre-forms and documentation to empower him to send and expedite the process.